In late 2020, Ocean Strategies launched a Covid-19 impact survey to better understand how the global pandemic is impacting West Coast and Alaska fishermen as well as national seafood distributors. Over 350 fishermen and seafood distribution companies responded to last year’s survey, and we’re proud to see the results included in a newly released NOAA Fisheries economic assessment of Covid-19’s effect on seafood and fishing industries.

This updated report, U.S. Seafood Industry and For-Hire Sector Impacts from COVID-19: 2020 in Perspective, shared with Congress and the public, identifies long-term challenges within the domestic seafood sector due to the Covid public health crisis. Key findings from NOAA’s analysis are outlined below.

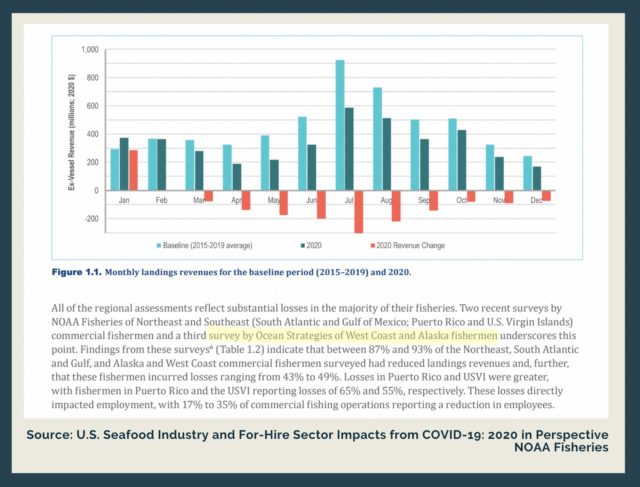

- Overall, commercial fishing landings revenue declined 22% in 2020 relative to the five-year baseline (2015–2019), with all regions experiencing a significant decline.

- The largest monthly decline occurred in July, largely driven by declines in Alaska landings revenue. Alaska landings for 2020 declined by 26% overall.

- In Alaska, halibut, Pacific cod, and salmon landings revenues were markedly down on a combination of lower landings and lower prices. Relative to the baseline, revenues for these species declined 41% (halibut) to 47% (Pacific cod at-sea sector).

- West Coast commercial landings declined by 24%.

- The largest monthly decline occurred in July, largely driven by declines in Alaska landings revenue. Alaska landings for 2020 declined by 26% overall.

- Aquaculture operations also faced disrupted markets domestically and globally as well as increased costs from having to maintain product while businesses searched for new markets.

- Seafood retail sales increased significantly in 2020 across all seafood categories: frozen, up 36%; fresh, up 25%; and grocery (canned, pouches, etc.), up 21%. In contrast, foodservice sales declined sharply.

- Importing dealers and processors experienced a smaller percentage decline in revenues than domestic producers between late 2019 and mid 2020, with import value added falling by 10.54% . Given the larger scale of this sector, however, overall losses ($372 million) were greater than domestic producers ($249 million).

- Both domestic and imported seafood saw an increase in value starting in Q3 of 2020, and another decline in Q4, with domestic producers experiencing a greater fluctuation than importers.

Ocean Strategies thanks the 350+ fisherman and all seafood distribution companies that responded to last year’s survey! For any follow-up information please contact Ocean Strategies staff.